Retail media is a very hot topic right now in the worlds of ecommerce and marketing, with various headline stats paying testament to its recent significant – and future predicted – growth, in a generally challenging advertising market.

But retail media can be a confusing area, seen as a pretty new channel by some (“digital advertising’s third wave”) while also in parts being much older than the internet itself, as retailers have sold shelf space and other promotional opportunities for decades.

This blog seeks to demystify the quickly developing world of retail media, define its disparate strands and also provide some pointers as to how brands can maximise the opportunity.

Retail media’s growth: Amazon leading the charge

Retail media’s development and growth has been much discussed recently in many diverse forums.

For example, retail media’s growth was the hottest topic by far at January’s huge NRF (National Retail Federation) conference in New York, much centred around research from WARC showing that retail media is already the fourth largest channel by ad spend and is rapidly nearing linear TV in third place. Retail media was forecast to grow by 10% in 2024 despite the tough economic headwinds.

The US has been leading the way in retail media growth but Europe is following fast, especially the UK. Emarketer estimate that UK retail media spend will grow by 24% to just over $4bn in 2024, and will then nearly double in 3 years, touching $8bn by 2027.

However, as Press Gazette point out, a very large proportion of this spend is accounted for by ecommerce behemoth Amazon. This again follows the US trend, where Amazon is forecast to account for 14.4% of total digital ad revenue on 2024, dwarfing all other media outside of Google and Meta. In the UK, Amazon is currently 7.5% of digital budget, but this is rapidly growing.

Defining the retail media ecosystem

So Amazon is a dominant force and spearheading much of the headline stats and chatter around retail media, but it’s not the only game in time – and indeed the general retail media ecsosystem can be difficult to navigate.

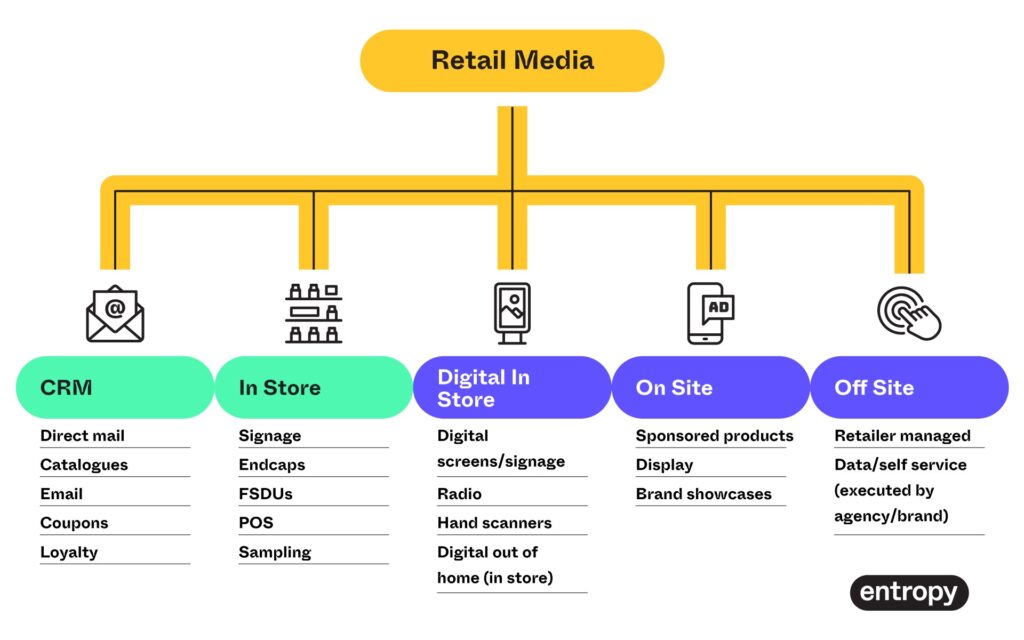

To help with this and provide greater clarity for advertisers, IAB Europe segment retail media into five main areas – the more traditional in-store and CRM, as well as digital in-store, on site and off site – which we at Entropy think is a helpful and logical way to define retail media.

CRM: includes direct mail, catalogues, email, coupons, vouchers, loyalty

In-store (traditional): includes signage, endcaps, FSDUs, POS, sampling

Digital in-store: includes digital screens/signage, radio, hand scanners, digital out of home (in store)

Digital on-site: includes sponsored products, display, brand showcases

Digital off-site: delivered on digital inventory off retailer sites. Can be retailer managed (executed by retailer) or data/self service (executed by agency or brand).

Retail media: ad spend or supplier/trade funding?

As well as Amazon – and spurred on by its success in optimising retail media – other large retailers are increasingly setting up their own Retail Media Networks (RMNs) to sell their own digital inventory to brands There are now over 200 RNMs globally, led by US brands but Mimbi estimate there are 24 in the UK, from Argos to Zalando, from Tesco to Ocado.

However, as this new kid on the block (RMNs) starts to gobble up ever larger budgets, this is leading some brands to question their overall spend with retailers. While traditional retail media (endcaps, catalogues etc) was historically transacted between retail buying teams and brand sales teams, the advent of digital retail media and RMNs is bringing new dynamics into play – as for brands it still all boils down to paying retailers to promote their products in advantageous ways.

And whereas the historic “supplier funding/trade marketing” model for traditional retail media often reigned supreme in total spend terms – the huge growth in digital media has led Forbes to observe that: “for the first time perhaps ever, retailers are willing to cross the streams of once untouchable trade funds vs. advertising.”

Optimising retail media investment

What this means for brands is the need to become ever more sophisticated in how they are measuring – and optimising – spend across their varied channels, and now including retail media within that, as one of our other recent blogs highlighted.

At Entropy, we are seeing a big increase in brands asking us to help with their measurement in a more sophisticated way via our MMM (Marketing Mix Modelling) or econometrics services.

And the rise in Amazon retail media in particular has meant that we have also developed a specific Amazon MMM offering which allows you to measure the true performance of your Amazon ad spend investment and optimise for future growth with Amazon MMM by Entropy. This is a much wider review than standard metrics and includes looking at all factors that drive Amazon sales (pricing, promotions, competitors, seasonality) as well as even looking at the impact that Amazon ads can have on driving “off Amazon” sales – to give a true holistic evaluation of spend.

To conclude, the richness of retail media data – and proximity to the customer’s purchase decision – provides a huge opportunity for brands that use it well to maximise their sales, but the importance of measuring and analysing well for future optimism should not be underestimated.